A large majority of businesses have experienced an invoice in which they simply cannot collect any or a part of the full invoiced amount. Whether it's due to our current troubled economy resulting in a client's inability to pay, a deadbeat client, or a client who is just not happy with your total invoice or a portion of the total, your business is likely to be faced with writing off an uncollectable invoice(s). This blog article is all about teaching you, as a user of QuickBooks, how to properly write-off or reduce the amount of an invoice. Below are the steps and some pictures of screenshots that will help you to learn this rather simple task and will keep your true collectable A/R accurate.

- Let's say you have an aging invoice from last year and the amount owed in our example invoice is $1028.14. You have just learned your client has since gone out of business and you deem it is time to just forget about ever collecting these monies. You could delete the invoice, right? Bad idea. Why? It would change the Balance Sheet and Profit & Loss Statement in which your last year's tax return is based on. You don't want to do this! Rather, the correct way to handle this is to write-off this invoice in the current year. If you are required to report financials to a banking institution, a Board of Directors or some other financial accountability entity, you need to give thought to what date you use to write-off the bad debt. The reason is if you have already submitted financial data, you don't want to change what had already been submitted. If the aforementioned is not of any consideration, the date you use is less important so long as the chosen date is in the current year.

- To write-off the debt in QuickBooks, go to Customers, Receive Payments.

- Enter your client's name and Tab to the next field. QuickBooks will reveal all Open invoices for this client.

- Do NOT enter any amount in the amount field. Leave it at $0.

- Date your transaction based upon your decision from number 1 above.

- You can skip the Payment Method, Check/Ref and Memo fields.

- Next, single-click on the invoice you are writing off. This will highlight the invoice. If there is more than one invoice to be written off, we'll address this scenario in a moment.

- Now, click on the button "Discount & Credits..."

- From the Discount Tab enter the amount to be written off in the Amount of Discount field. Depending upon your desired outcome (i.e., to write-off the invoice balance in full, or to simply reduce the amount to be paid), will determine the amount you enter in this field

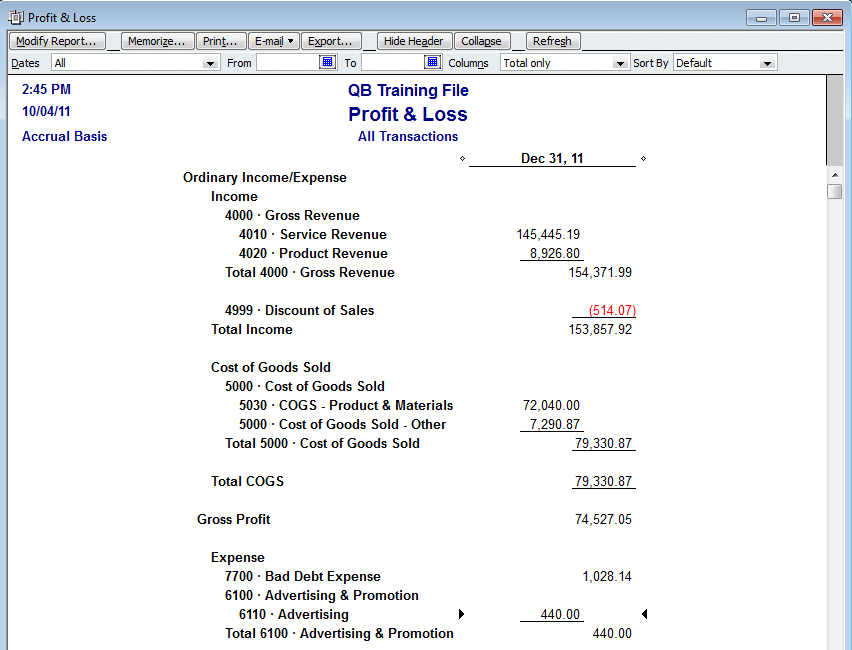

- Select an appropriate account from the Discount Account pull down. In the picture below I have selected the G/L expense type account 7700 · Bad Debt Expense. If I were simply electing to discount an invoice in the interest of goodwill towards a client I would select an income account called 4999 · Discount of Sales. Either way, you may already have similar accounts setup or you may find you need to add these accounts. This blog posting assumes you know how to accomplish the addition of G/L accounts.

- If you utilize Class Tracking in QuickBooks select a Discount Class. If you don't have the Class Tracking feature turned on this field will not be shown.

- Click on Done.

- If there is more than one invoice to be written off single click on the next invoice and repeat steps 8 - 12.

- Finally, click on Save & New or Save & Close.

The Profit and Loss picture below shows the results of a Bad Debt and Discount of Sales transaction, as described above, having been recorded:

Ok, a little note about Cash Basis accounting versus Accrual Basis accounting and how the above impacts your method of accounting. The only way you can truly write-off a bad debt in a business is if you are on the Accrual Method of accounting. This is because, in an Accrual Basis world, most revenue is recognized when the invoice is created and not when the payment is received against an invoice. Likewise, in an Accrual Basis world most expenses are recognized the moment bill is recorded, not when the bill is paid. In a Cash Basis world revenue is not recognized until the payment is received against the invoice. Additionally, expenses are not recognized until entered bills are actually paid. As a result of this reality you cannot write-off unrecognized revenue (i.e., Cash Basis). Even so, I prefer to still show the Bad Debt write-off and then let the CPA make an adjustment on the tax return when that year's tax return is processed. When all is said and done I still have information about what was uncollectable and an Adjusting Journal Entry can be made to remove the disallowed expense (again, Cash Basis) as of 12/31 (assuming you operate on a calendar year).

Like what you see? Have questions regarding this blog posting or perhaps you have questions about how to do something else in QuickBooks? Call QuickTrainer, Inc. at 910-338-0488 or leave us a comment on this page and let us know.